child tax credit september 2020

In addition the qualifications for the child tax credit have broadened meaning more families can now qualify that previously could not. Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers.

Childctc The Child Tax Credit The White House

Complete IRS Tax Forms Online or Print Government Tax Documents.

. Millions of families across the US will be receiving their third advance child tax credit payment next week on Sept. Part of this credit can be refundable so it may give a taxpayer a refund even if they dont owe any tax. SOME eligible parents are furious they are still waiting to receive their September child tax credit payments but the IRS is promising the check is on its way.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. This interview will help you determine if a person qualifies you for the Child Tax Credit or the Credit for Other Dependents. Dont assume you cant qualify for the refundable credit just because you didnt qualify in prior years.

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 per child for qualifying children under the age of 6 and to 3000 per child for qualifying children ages 6 through 17. 1151 ET Sep 27 2021. If your adjusted gross income is 150000 in 2020 youre well below the phase-out threshold and youd be entitled to the full Child Tax Credit.

Up to 3600 per qualifying dependent child under 6 on Dec. How Much is the Child Tax Credit. Taxpayers may be able to claim the child tax credit if they have a qualifying child under the age of 17.

Up to 3000 per qualifying dependent child 17 or younger on Dec. For the 2021 tax year the child tax credit offers. The credit was made fully refundable.

1119 ET Sep 27 2021. The Child Tax Credit can be worth as much as 3500 per child for Tax Year 2021. IR-2021-188 September 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September.

The credit amount was increased for 2021. Reasons you didnt get a child tax credit payment. The third payment went out on September 17 but the agency said on Friday they had to fix a technical issue that caused delays.

30 will apply starting with the september payment. This is a significant increase. IRS Tax Tip 2020-28 March 2 2020.

Specifically the Child Tax Credit was revised in the following ways for 2021. The FFCRA provides businesses with tax credits to cover certain costs of providing employees with paid sick leave and expanded family and medical leave for reasons related to COVID-19 for periods of leave from April 1 2020 through March 31 2021. No Tax Knowledge Needed.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. With the Additional Child Tax Credit up to 1400 of the 2020 credit is refundable meaning that if it exceeds your income tax liability for the year the IRS will issue a refund check for the difference. Some parents may not want to get the monthly payments particularly if their incomes increase this yearThe payments are credits toward families tax liability for 2021 but are based on 2020 or.

The COVID-related Tax Relief Act of 2020 extends the tax credits available to Eligible Employers for paid. You could be getting up to 300 for each kid under 6 years old and 250 for. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

It has gone from 2000 per child in 2020 to 3600 for each child under age 6. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or. AGI is the sum of ones wages interest dividends alimony retirement distributions and other sources of income minus certain deductions such as student loan interest alimony payments and retirement contributions.

Enter Payment Info Here tool or. For 2021 only the child tax credit amount is increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to. The persons date of birth.

IRSnews IRSnews September 18 2021 The IRS issued about 15 billion in child tax credit payments to about 35 million families this month. For Tax Years 2018-2020 the maximum refundable portion of the credit is 1400 equal. Canada child benefit CCB Includes related provincial and territorial programs.

Ad The new advance Child Tax Credit is based on your previously filed tax return. But the many families who havent received the. Whether you can claim the person as a dependent.

For each child ages 6 to 16 its increased from 2000 to 3000. It also now makes 17-year-olds eligible for the. The taxpayers qualifying child must have a Social Security number issued by the Social Security Administration before the due date.

Who is Eligible. The child tax credit has increased from 1000 to 2000 per child maximum of 3 for families with children. The updated Child Tax Credit is based on parents modified adjusted gross income AGI as reflected on their 2020 tax filing.

To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. The advance is 50 of your child tax credit with the rest claimed on next years return. TurboTax Makes It Easy To Get Your Taxes Done Right.

The Child Tax Credit is intended to offset the many expenses of raising children. Before 2021 the credit was worth up to 2000 per eligible child and children 17 years and older were not eligible for the credit. Get Your Max Refund Today.

Expiration Of Child Tax Credits Hits Home Pbs Newshour

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

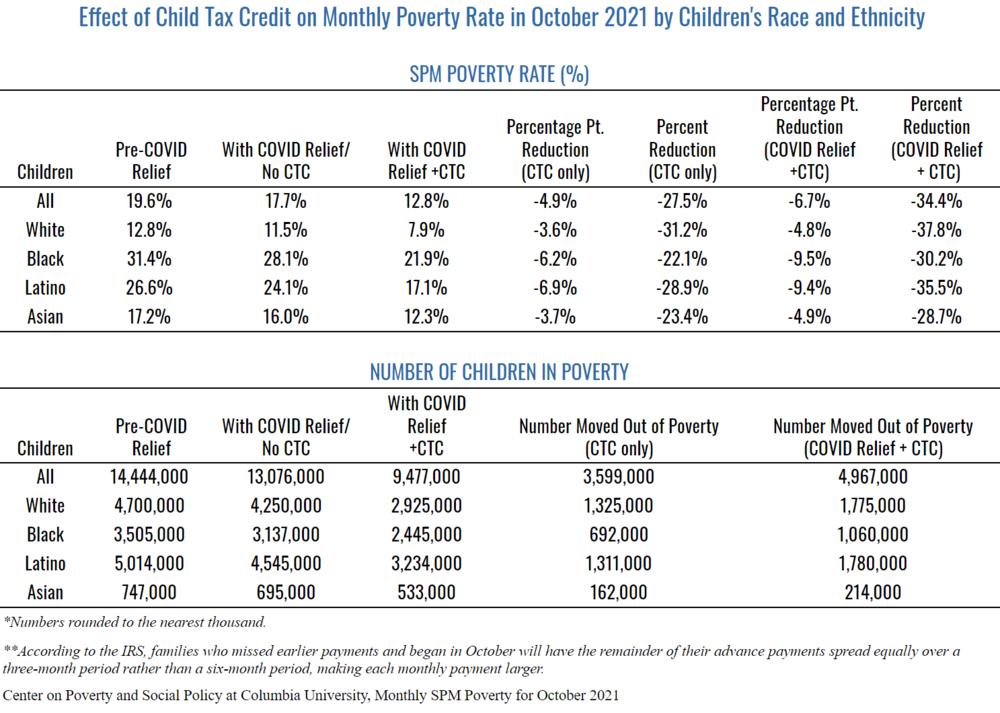

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Parents Guide To The Child Tax Credit Nextadvisor With Time

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

September 2020 Business Due Dates Due Date Business Income Tax Return

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit You Need This Irs Letter To Get Your Money Cnet

Child Tax Credit United States Wikipedia

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Here S What You Need To Know About Child Tax Credit Payments The Washington Post

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com